Qualified Business Deduction 2024 List – Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . Ready or not, the 2024 deduction. Bonus depreciation, implemented by the Tax Cuts and Jobs Act (TCJA) in 2017, allows business owners to write off a large percentage of the cost of a qualified .

Qualified Business Deduction 2024 List

Source : www.freshbooks.comS Corporation Beginner’s Guide, Updated Edition: The Most Complete

Source : www.amazon.comHometown Bookkeeping | Minonk IL

Source : www.facebook.comHSA Eligible Expenses in 2023 and 2024 that Qualify for

Source : www.fool.comPacker Thomas | Canfield OH

Source : www.facebook.comSmall Business Tax Deductions Cheat Sheet, Tax Deductions Item

Source : www.etsy.comDiplomat Business & Tax Solutions

Source : www.facebook.comHSA Eligible Expenses in 2023 and 2024 that Qualify for

Source : www.fool.comEsco Business Solutions LLC

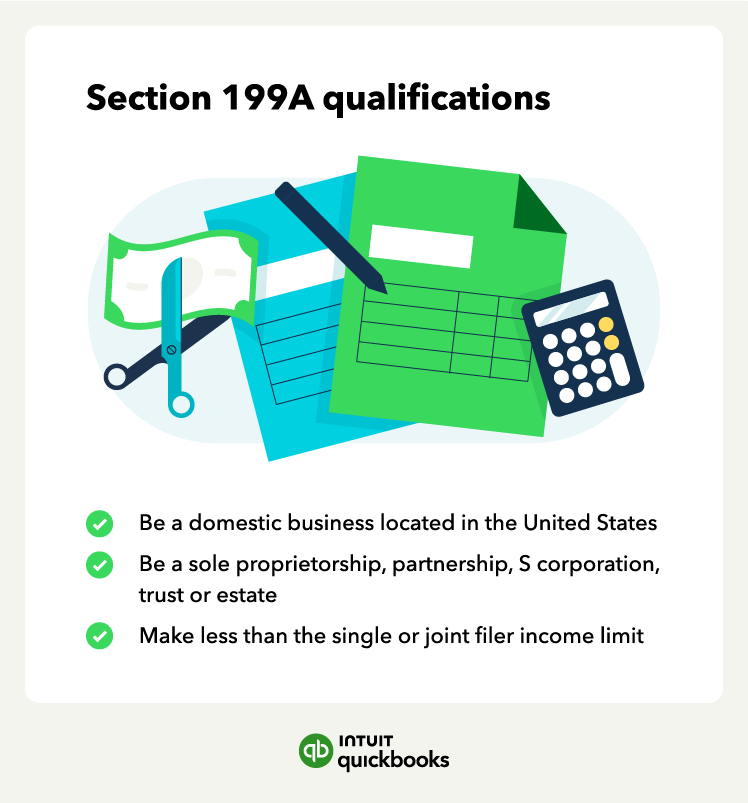

Source : m.facebook.comSection 199A deduction explained for 2024 | QuickBooks

Source : quickbooks.intuit.comQualified Business Deduction 2024 List 25 Small Business Tax Deductions To Know in 2024: There are tons of popular tax breaks out there. Whether you’re a new car owner, a student loan payer or a retiree with high medical costs, there are some important ones to know about. . As 2024 has just begun To create a benefit for the owners of those business entities, a qualified business deduction provides up to a 20% deduction on the pass-through earnings of a qualifying .

]]>